Supporting a high-growth SaaS company in a successful $33 million exit

When a newly formed SaaS company engaged us 16 months ago, they set a clear goal: to prepare for a successful exit in 3-4 years. With $5 million in annual revenue, $1 million in EBT, and $3.7 million in current assets, the company had a solid foundation. Their overseas operations, established for two years, had built a strong recurring customer base, which quickly attracted buyer interest.

However, just one year into the engagement, the company received an unexpected $33 million acquisition offer, requiring them to fast-track their exit strategy. With proactive financial planning, clean accounting records, and compliance-ready systems already in place, the company was fully prepared to meet the rigorous demands of due diligence and execute a seamless transaction.

From Chaos to Clarity: Achieving Financial and Operational Excellence

After years of managing diverse revenue streams and expanding its operations, a growing business faced significant challenges in maintaining accurate financial records and efficient processes. The increasing complexity of its financial operations hindered leadership’s ability to make informed decisions and attract investor confidence.

Our firm was engaged to develop an achievable roadmap to get the organization back on track and establish a robust financial foundation.

Over the course of 12 weeks, we worked with the business’s leadership team to design a financial strategy aligned with their goals of improving operational efficiency, financial clarity, and stakeholder trust.

Understanding the Three Key Approaches to Valuing a Business

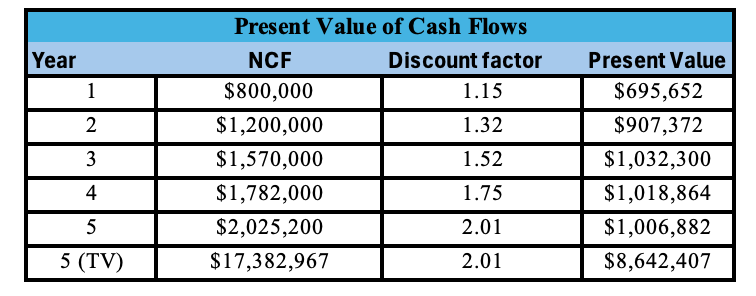

Valuing a business with precision is critical for a range of strategic decisions, from securing investor funding to executing a successful exit strategy. The three primary valuation approaches widely recognized in the field are the Income Approach, the Market Approach, and the Cost Approach. Each of these methodologies provides distinct perspectives and is applicable to various types of businesses and scenarios. Within these broad approaches, several specific methods can be employed, each chosen based on a set of unique factors and circumstances pertinent to the business in question. The methods discussed herein represent just a few of the available techniques.

Additionally, it is imperative to consider qualitative factors during the valuation process. Elements such as the strength and expertise of the management team, the strategic vision, market positioning, and the level of innovation and proprietary technology can significantly influence the perceived value of a business. These qualitative aspects often provide a more comprehensive understanding of the business’s potential for long-term success and sustainability, which can be pivotal in making informed valuation decisions.