Quality of Earnings (QoE) Analysis in Financial Due Diligence

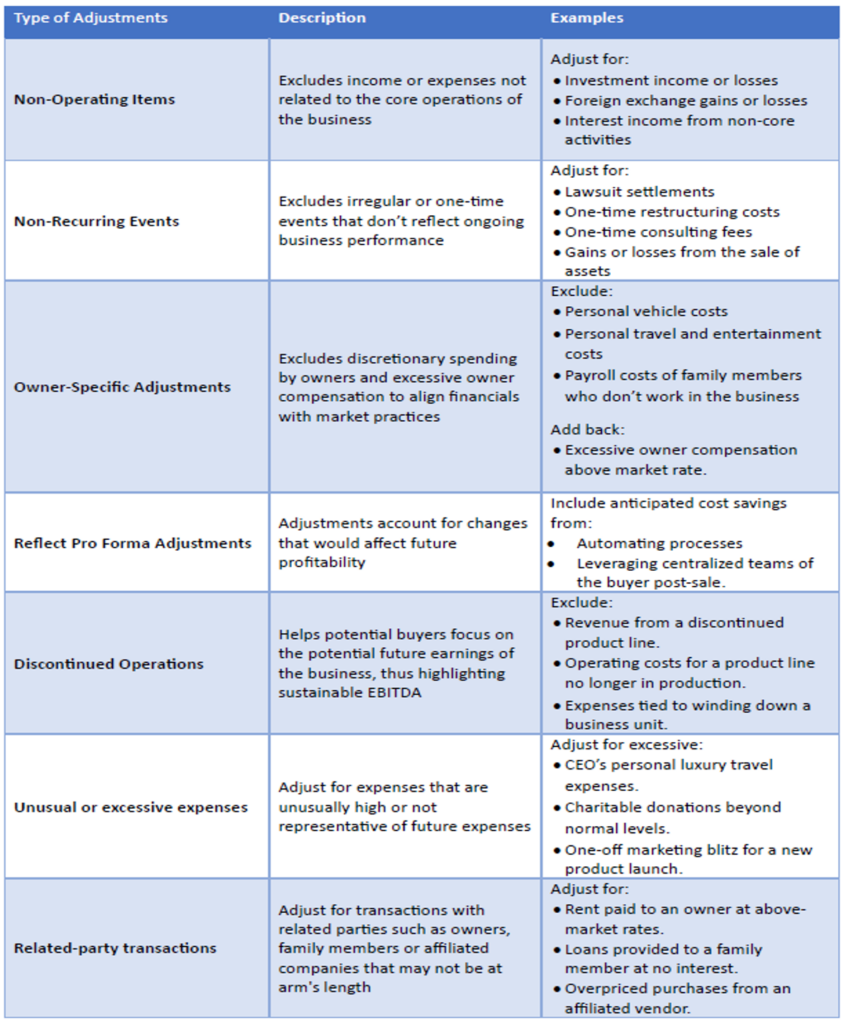

When preparing a business for sale, the Quality of Earnings (QoE) report often becomes a centerpiece of the process. But what exactly is it, and why does it matter so much?

A QoE report dives deep into a company’s earnings, separating recurring revenues from one-time windfalls and identifying trends, risks, and irregularities. It answers a key question for potential buyers: “Is this business’s financial performance sustainable in the future?”

From Chaos to Clarity: Achieving Financial and Operational Excellence

After years of managing diverse revenue streams and expanding its operations, a growing business faced significant challenges in maintaining accurate financial records and efficient processes. The increasing complexity of its financial operations hindered leadership’s ability to make informed decisions and attract investor confidence.

Our firm was engaged to develop an achievable roadmap to get the organization back on track and establish a robust financial foundation.

Over the course of 12 weeks, we worked with the business’s leadership team to design a financial strategy aligned with their goals of improving operational efficiency, financial clarity, and stakeholder trust.

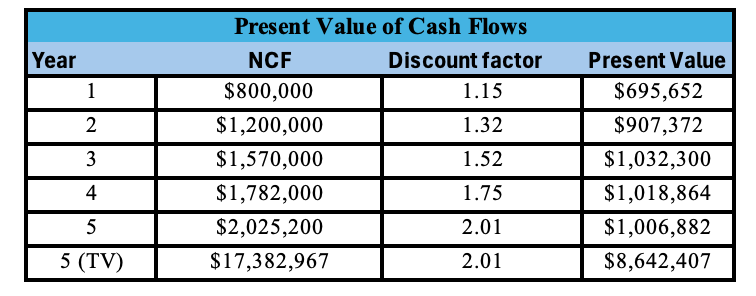

Understanding the Three Key Approaches to Valuing a Business

Valuing a business with precision is critical for a range of strategic decisions, from securing investor funding to executing a successful exit strategy. The three primary valuation approaches widely recognized in the field are the Income Approach, the Market Approach, and the Cost Approach. Each of these methodologies provides distinct perspectives and is applicable to various types of businesses and scenarios. Within these broad approaches, several specific methods can be employed, each chosen based on a set of unique factors and circumstances pertinent to the business in question. The methods discussed herein represent just a few of the available techniques.

Additionally, it is imperative to consider qualitative factors during the valuation process. Elements such as the strength and expertise of the management team, the strategic vision, market positioning, and the level of innovation and proprietary technology can significantly influence the perceived value of a business. These qualitative aspects often provide a more comprehensive understanding of the business’s potential for long-term success and sustainability, which can be pivotal in making informed valuation decisions.

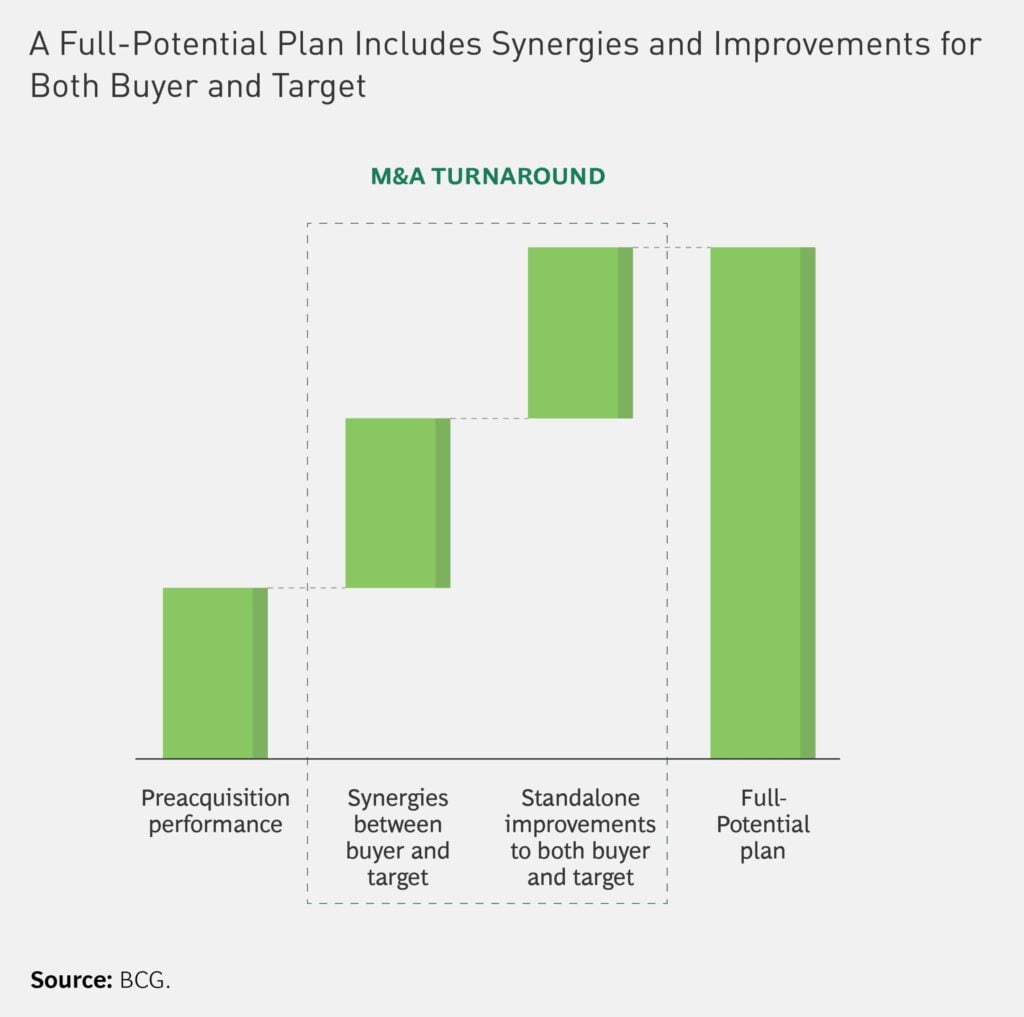

5 Transformative Powers of Strategic Ownership in Mergers and Acquisitions

In the evolving landscape of mergers and acquisitions (M&A), the strategic capabilities and vision of the acquiring company profoundly influence the trajectory and ultimate success of the acquired assets.

Unraveling Business Combinations: Navigating Accounting Challenges

In the dynamic world of business, expansion and diversification are often crucial strategies for long-term success. However, these strategic moves can open new doors while also unveiling intricate challenges