Understanding Quality of Earnings (QoE): Why It’s crucial for Business Exits

When preparing a business for sale, the Quality of Earnings (QoE) report often becomes a centerpiece of the process. But what exactly is it, and why does it matter so much?

A QoE report dives deep into a company’s earnings, separating recurring revenues from one-time windfalls and identifying trends, risks, and irregularities. It answers a key question for potential buyers: “Is this business’s financial performance sustainable in the future?”

In short, QoE refers to the extent to which the reported earnings of a business reflect the underlying economic characteristics of its normal and recurring operations.

Quality is typically assessed as how sustainable, controllable and predictable the reported earnings of the business are.

Sellers tend to take an optimistic view of underlying EBITDA to maximize the price achieved. They aim to justify their proposed value by highlighting growth potential, downplaying risks identified in the QoE and offering alternative explanations for disputed adjustments.

Buyers tend to take a conservative view to reduce the price and mitigate the risk of losing value. They aim to reduce the purchase price by questioning the quality or predictability of earnings and applying a lower valuation multiple due to perceived risks.

The buyer and seller reach an agreement on normalized EBITDA, often after several rounds of discussions. The agreed-upon earnings form the basis for applying the valuation multiple and setting the purchase price.

Why QoE Matters

- Accuracy: Buyers want confidence that reported earnings reflect reality, not inflated or misrepresented figures.

- Risk Reduction: It highlights areas like customer concentration, seasonality or reliance on specific contracts that might be red flags.

- Valuation: Clean and reliable earnings increase the likelihood of achieving a higher valuation.

What Sellers Should Know

- A QoE report isn’t just for buyers. As a seller, preparing a QoE analysis early can uncover issues to address before entering the market.

- It’s not just about the numbers. A strong narrative, supported by robust financial data creates trust and positions your business as a well-oiled machine.

EBITDA = Earnings before interest, tax, depreciation and amortization.

QoE = Reported EBITDA +/- Adjustments = Underlying EBITDA

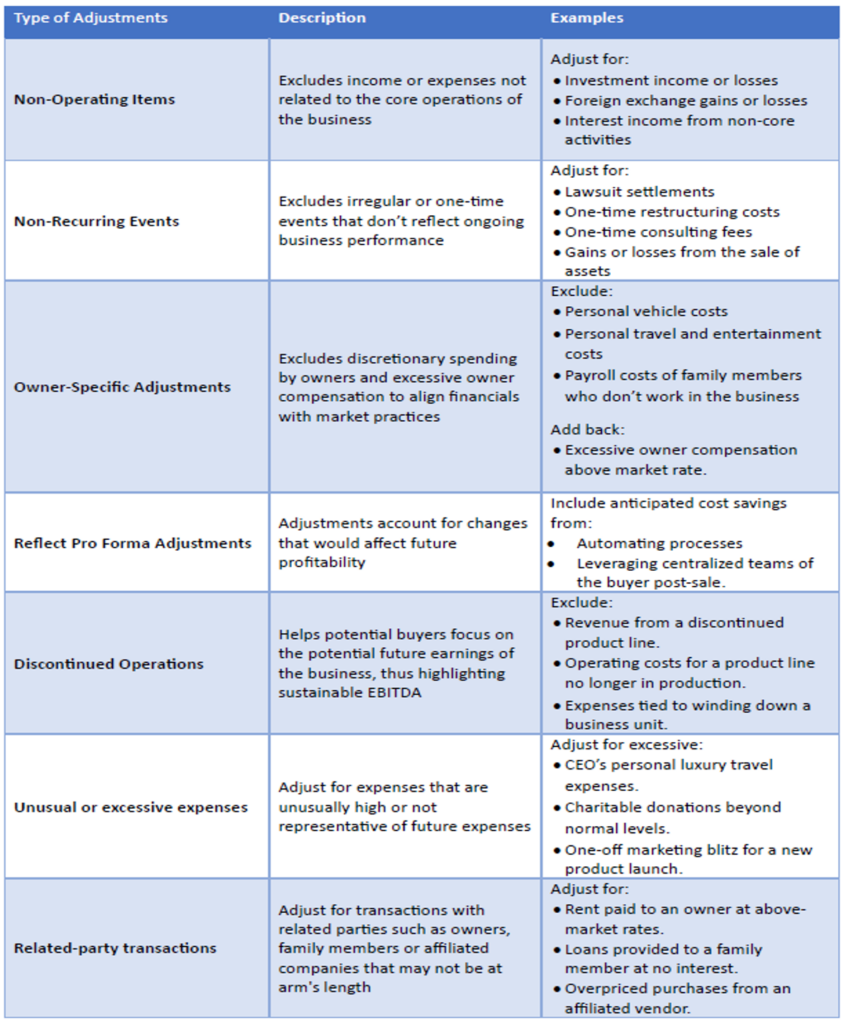

Here’s an explanation to highlight why certain types of adjustments in EBITDA are necessary to calculate QoE: –

In Financial Due Diligence, the spotlight is often on QoE—and for good reason. Deal valuations frequently hinge on adjusted EBITDA rather than management’s reported numbers. Even minor adjustments can create ripple effects; for instance, reducing EBITDA by $100k on a 10x multiple deal can lower the price by $1 million. This is why even the smallest details are scrutinized—they could mean the difference between a fair valuation and a costly oversight.